Reagan roundup

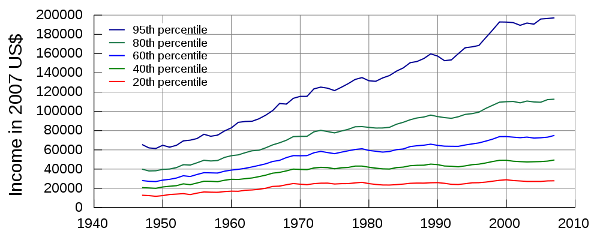

The recent centenary of the birth of Ronald Reagan has had conservative pundits pouring on the hagiography in their usual ahistorical manner, and ignoring the inconvenient fact that decades of Reganomics -- tax cuts for the rich, deficient spending, anti-union tactics, deregulation of the financial industry, and a shredding of the social safety net -- are responsible for the economic mess in which the nation finds itself.

Here, then, a few clearer looks at the legacy of the President whom one wag -- I wish I could remember who -- described as doing for the U.S. what anabolic steroids do for athletes: big muscles, sure, at the cost of withered testicles.

you have the right to remain silent, and you'd better use it.

For years I've been passing on the message that, even if you are 100% innocent of wrongdoing, the only things you say to a cop (outside of a purely social interaction, of course, or when filing a complaint yourself), are "Am I free to go?" and "I want a lawyer." In this great video, Professor James Duane explains why Fifth Amendment protections are so vital and why you should not talk to the police, even when you've done absolutely nothing wrong.

Did you know that nothing you say to a cop can be used as evidence in your favor in court -- that's considered hearsay -- but everything you say can used against you? Did you know how even things that seem completely innocuous or exculpatory can be used against you in court? Watch the video. It's 27 minutes and 25 seconds that could keep you out of big trouble. (It's also worth watching the next part of this presentation, with Officer George Bruch from the Virginia Beach police department talking about criminal interrogation strategies.)

veggies, fruits, and grains for longer life

Yet again, a scientific study shows that if you don't want to die, plant-based nutrition is the way. A study published in the Archives of Internal Medicine shows that intake of dietary fiber -- which comes only from vegetables, fruits, legumes, nuts, seeds, and grains, and is not found in meat, eggs, or dairy products -- was associated with a lowered risk of death from cardiovascular, infectious, and respiratory diseases in both men (24% to 56% lower) and women (34% to 59% lower). Fiber was also found to be protective against cancer in men, though a significant effect was not found in women -- perhaps because men are more likely to die from cancers with a strong dietary link, such as esophageal cancer.

Putting yet another nail in the coffin of the psudeoscientific "paleo" diet fad, the results showed that fiber from grains (discouraged in paleo diets) was most strongly tied to lowered risk.

The study, conducted by the National Institutes of Health and AARP, included more than 388,000 people ages 50 to 71. Diet was self-reported by a questionnaire that asked participants to estimate how often they ate 124 food items. After nine years, more than 31,000 of the participants had died, and national records were used to find out who died and the cause of death.

Risk factors including weight, education level, smoking and health status were accounted for in the statistical analysis, but the protective effect of fiber remained.

original intent, health care mandates, and federal power over the states

I recently discussed how the "original intent" doctrine of Constitutional interpretation is intellectually bankrupt, leading as it does to contradiction since the intent of the Framers was that their intent not be used as a guide to the document. But it's unlikely that this idea is going to go away soon. So it's perhaps worthwhile -- and definitely interesting, even entertaining -- to take a look at the opinions of the Framers on two issues that currently cause a lot of pettifoggery, health care mandates and "state's rights". When we do, we see that (as usual) the people invoking the names of the Framers the loudest, have got those gentlemen's opinions exactly wrong.

First, health care. Now, I am not a fan of the mandate to purchase health insurance. I think that, without the public option, it's a bad policy. But "bad policy" is not the same as "unconstitutional". Do we have some historical insight into what the Framers might have thought about the federal government messing with the "free market" by mandating that people buy health insurance?

As it happens, we do.

Congratulations Egypt!!!!!

According to the AP, Egyptian president Hosni Mubarak has finally resigned, and handed power to the military, the group probably most respected by the Egyptian people. The top military body, the Armed Forces Supreme Council, has vowed to guide the nation towards democracy.

This is an amazing moment not just for the people of Egypt but for human rights and democracy.

This is how democracy comes about -- not brought into a nation by invaders, but grown from the roots up by the people.

Congratulations to the people of Egypt.

Federal taxes at a 60-year low

As I've mentioned before, the "American are overtaxed!" meme is counter-factual. In fact, as the AP reports, this year federal taxes as a share of GDP -- 14.8% -- will be the lowest since 1950. In W's last year in office, the figure was 17.5%.

Combine the ever-growing deductions, credits and exemptions (which lower the effective tax rate) with the crappy economy (which lowers the amount out there to tax) and, according to the CBO, income tax payments will be nearly 13% percent lower than in 2008, and corporate taxes will be lower by a third.

As the chairman of the Senate Budget Committee. Ken Conrad, says, "The current state of the tax code is simply indefensible. It is hemorrhaging revenue."

And even Donald Marron, a former economic adviser to Bush, says "America's tax system is clearly broken. It fails at its most basic task, which, lest we forget, is raising enough money to pay for the federal government."

The AP had The Tax Institute at H&R Block compared some hypothetical family's tax bills for 2008 and 2010. While tax rates are the same, Obama has put in place more generous tax credits -- many as part of the 2009 economic stimulus package.

Here are the scenarios:

— A married couple with two young children and a combined income of $25,000 will pay no federal income taxes for 2010. Instead, they'll get a payment of $7,085 — up from $6,700 in 2008...

— A married couple with two children, including one in college, and a combined income of $50,000 would pay no federal income taxes, instead getting a payment of $734 from the government this year. However, they did better in 2008 when they netted a $1,234 payment from the government...

— A single person making $50,000 while paying interest on a student loan would have a 2010 tax bill of $5,325 — a $63 decrease from 2008...

— A married couple with two children, including one in college, with some modest investments and a combined income of $200,000 will see their federal income tax bill drop by $780, to $28,496...

-A rich couple with two kids in college, larger investments and a combined income of $1 million will see their taxes drop by $6,740, to $277,699 in 2010...

Zelda's Inferno exercise: "moving down the street at a dancing pace"

Zelda's Inferno exercise: write a poem from the following randomly-generated wordlist (from http://watchout4snakes.com/CreativityTools/RandomWord/RandomWord.aspx)

drop project dancing umbrella minister costing

pace candidate baffled conviction good action

moving down the street at a dancing pace

leave my baffled convictions behind me

drop loose the past that was taking up space

let it all go until I'm free

now freedom is good and freedom is great

but not something you can hold on to

lock it in a box and it disintegrates

you can't carry it with you

now that you've got your freedom

how will you hold on to it?

now that you've got your freedom

how will you hold on to it?

a year of Ringo

So it's Imbolc/Candlemas/Groundhog Day/almost Lunar/Chinese New Year, traditionally the tipping point between Winter and Spring. But around here it's also Ringo Day -- one year since this pit bull / boxer mix (or so the vet guessed) moved in.

Of course, living with a dog too tough for Texas has its interesting moments. He is of a breed labeled, by the Kong company, "a known extreme chewer"; several pairs of shoes have been sacrificed, as well as one book and a bunch of magazines and other papers. And two dog harnesses. And several small rugs. And he's left a few of my more delicate friends bruised with his enthusiastic love.

Still, all in all, I guess he can stay.

(Click on the thumbnails for large photos.)